Demystifying the Power of Markup: Understanding and Utilizing a 30% Markup Calculator

Related Articles: Demystifying the Power of Markup: Understanding and Utilizing a 30% Markup Calculator

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Demystifying the Power of Markup: Understanding and Utilizing a 30% Markup Calculator. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Demystifying the Power of Markup: Understanding and Utilizing a 30% Markup Calculator

- 2 Introduction

- 3 Demystifying the Power of Markup: Understanding and Utilizing a 30% Markup Calculator

- 3.1 Understanding Markup: The Foundation of Profitability

- 3.2 The Significance of a 30% Markup Calculator

- 3.3 Practical Applications of a 30% Markup Calculator

- 3.4 Understanding the Relationship between Markup and Profit Margin

- 3.5 Factors Influencing Markup Percentage

- 3.6 Beyond the 30% Mark: A Flexible Approach

- 3.7 Frequently Asked Questions (FAQs)

- 3.8 Tips for Utilizing a 30% Markup Calculator Effectively

- 3.9 Conclusion

- 4 Closure

Demystifying the Power of Markup: Understanding and Utilizing a 30% Markup Calculator

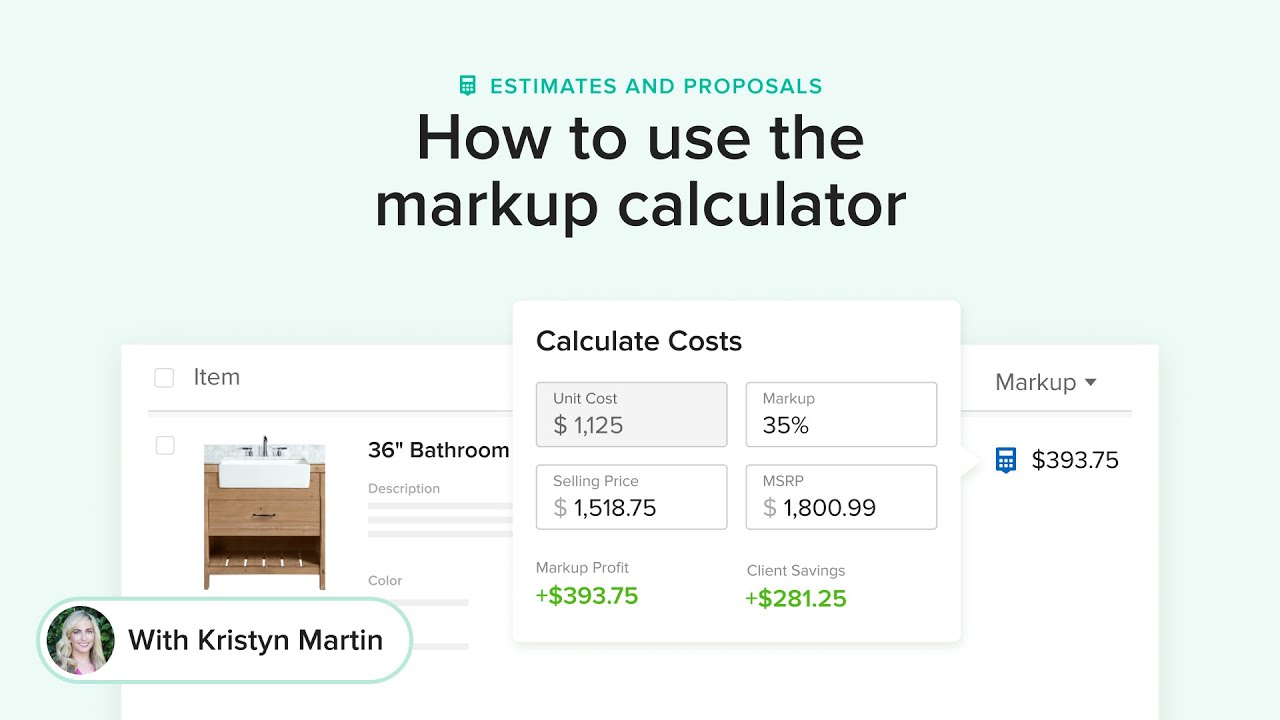

In the dynamic world of business, understanding and effectively managing costs and profits is paramount. One of the key tools employed in this process is a markup calculator, specifically a 30% markup calculator. This tool empowers businesses to determine the selling price of a product or service by adding a predetermined percentage, in this case, 30%, to the cost price. This article delves into the intricacies of a 30% markup calculator, shedding light on its significance and providing a comprehensive guide to its effective utilization.

Understanding Markup: The Foundation of Profitability

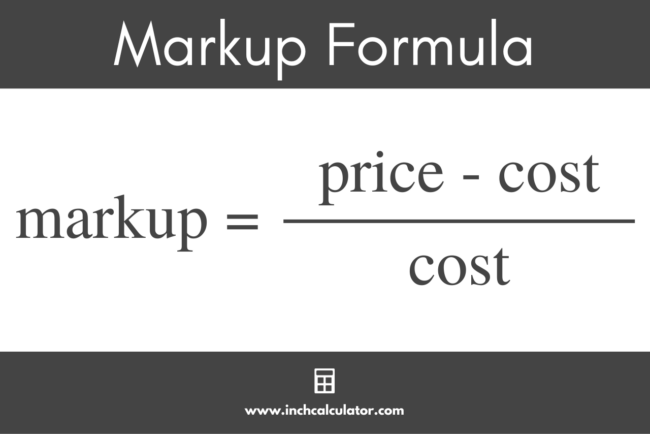

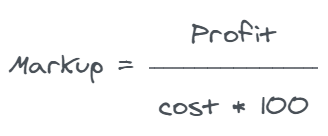

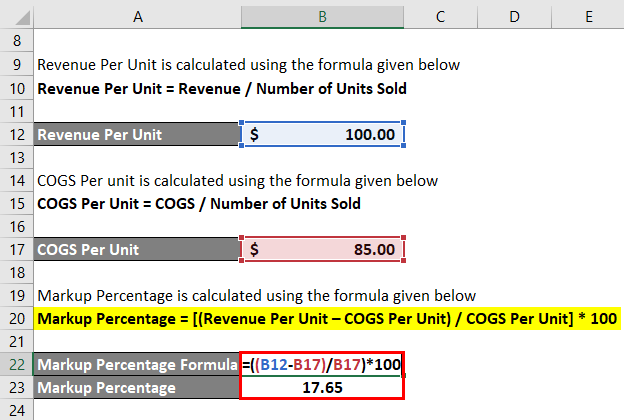

Markup, in its simplest form, represents the difference between the cost price of a product or service and its selling price. This difference is expressed as a percentage of the cost price. A 30% markup, therefore, signifies that the selling price is 30% higher than the cost price.

Consider a hypothetical scenario where a business acquires a product for $100. With a 30% markup, the selling price would be calculated as follows:

- Markup Amount: $100 x 30% = $30

- Selling Price: $100 + $30 = $130

This simple calculation highlights the core function of a markup calculator: to ensure that businesses generate a profit margin on each sale.

The Significance of a 30% Markup Calculator

A 30% markup calculator plays a pivotal role in the financial success of any business, offering several key benefits:

-

Profitability: The most fundamental advantage of a markup calculator is its ability to guarantee a consistent profit margin. By applying a predetermined markup percentage, businesses can ensure that each sale contributes to their overall profitability.

-

Pricing Accuracy: In a competitive market, accurate pricing is crucial. A markup calculator eliminates the need for manual calculations, minimizing the risk of errors and ensuring that prices are consistent and reflect the desired profit margin.

-

Cost Control: By automatically incorporating a markup, the calculator incentivizes businesses to control their costs. The higher the cost price, the higher the selling price, which encourages businesses to seek out more cost-effective suppliers and optimize their internal operations.

-

Strategic Decision-Making: A markup calculator provides valuable data for strategic decision-making. By analyzing the markup percentage and its impact on profitability, businesses can make informed decisions regarding pricing strategies, product offerings, and operational efficiency.

Practical Applications of a 30% Markup Calculator

The applications of a 30% markup calculator extend across various industries and business models. Here are some common scenarios where this tool proves invaluable:

-

Retail Businesses: Retailers can leverage a 30% markup calculator to set prices for a wide range of products, ensuring that they maintain a healthy profit margin while remaining competitive in the market.

-

Service Providers: Service providers, such as consultants, contractors, and freelancers, can use a markup calculator to determine their service fees, ensuring that they are compensated adequately for their time, expertise, and operational costs.

-

Manufacturers: Manufacturers can utilize a 30% markup calculator to calculate the selling price of their products, taking into account raw materials, labor, and overhead costs.

-

E-commerce Businesses: Online retailers can employ a markup calculator to optimize their pricing strategies, ensuring that they remain competitive while maintaining profitability in the highly competitive online marketplace.

Understanding the Relationship between Markup and Profit Margin

While markup and profit margin are often used interchangeably, they represent distinct concepts. It is essential to understand the difference to make informed pricing decisions.

-

Markup: As previously discussed, markup is the percentage increase applied to the cost price to determine the selling price.

-

Profit Margin: Profit margin, on the other hand, is the percentage of profit earned on each sale, calculated as (Profit / Selling Price) x 100.

The relationship between markup and profit margin is inversely proportional. A higher markup percentage generally leads to a higher profit margin, but only if the cost price remains constant.

For example, a 30% markup on a cost price of $100 results in a selling price of $130 and a profit margin of 23.08%. However, if the cost price increases to $120, the selling price becomes $156, but the profit margin drops to 20.51%.

Factors Influencing Markup Percentage

The choice of a 30% markup percentage is not arbitrary. Several factors influence this decision, including:

-

Industry Standards: Different industries have established norms regarding markup percentages. Researching industry benchmarks can provide valuable insights into the appropriate markup range for a particular business.

-

Competition: The level of competition in the market can influence markup percentages. In highly competitive markets, businesses may need to lower their markups to remain price-competitive.

-

Cost Structure: The cost structure of a business, including raw materials, labor, overhead, and marketing expenses, plays a significant role in determining the markup percentage. Businesses with higher costs may need to apply a higher markup to ensure profitability.

-

Customer Perception: The perceived value of a product or service also influences markup percentages. Premium products or services often command higher markups due to their perceived value and quality.

-

Business Goals: The overall business goals, such as growth, market share, or profit maximization, can influence markup strategies.

Beyond the 30% Mark: A Flexible Approach

While a 30% markup calculator can be a valuable tool, it is important to approach pricing strategies with flexibility. The ideal markup percentage may vary depending on the specific product or service, market conditions, and business goals.

For example, a business might apply a lower markup on high-volume products to attract customers and increase sales, while using a higher markup on niche products or services with lower competition.

Frequently Asked Questions (FAQs)

1. What is the difference between markup and margin?

Markup is the percentage increase added to the cost price to determine the selling price. Profit margin, on the other hand, is the percentage of profit earned on each sale, calculated as (Profit / Selling Price) x 100.

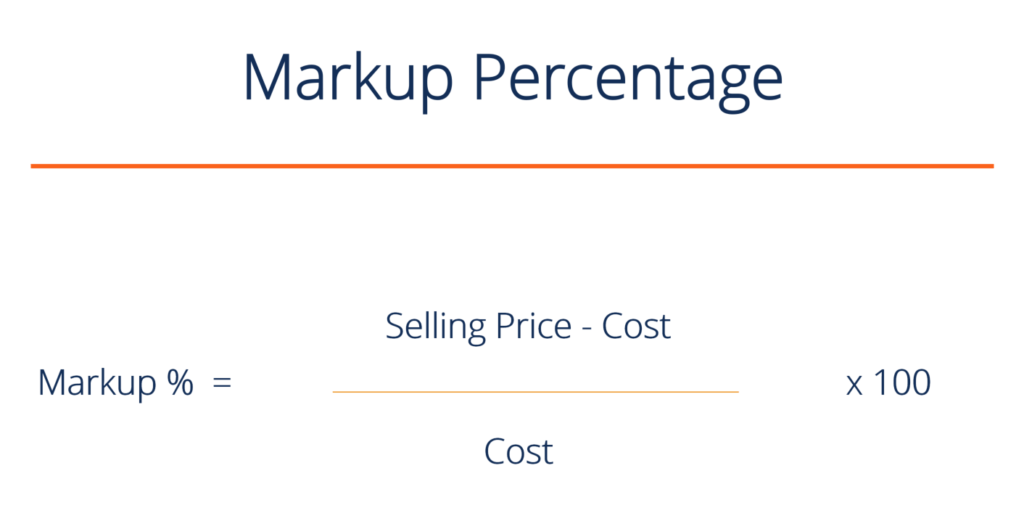

2. How do I calculate the markup percentage?

Markup percentage is calculated as (Selling Price – Cost Price) / Cost Price x 100.

3. Can I use a 30% markup calculator for all my products and services?

While a 30% markup calculator can be a useful starting point, the ideal markup percentage may vary depending on the specific product or service, market conditions, and business goals.

4. What are some of the limitations of a 30% markup calculator?

A 30% markup calculator does not take into account factors such as customer perception, competition, and market trends. It is essential to consider these factors when setting prices.

5. How can I optimize my pricing strategy using a markup calculator?

Start by researching industry benchmarks and analyzing your cost structure. Experiment with different markup percentages to determine the optimal balance between profitability and competitiveness.

Tips for Utilizing a 30% Markup Calculator Effectively

-

Understand Your Costs: Accurately track and analyze your costs to ensure that your markup percentage reflects your true expenses.

-

Research Industry Benchmarks: Gain insights into industry standards regarding markup percentages to inform your pricing decisions.

-

Consider Competition: Analyze your competitors’ pricing strategies to determine a competitive markup percentage.

-

Monitor Performance: Regularly track your sales and profit margins to assess the effectiveness of your markup strategy and make adjustments as needed.

-

Experiment and Adapt: Don’t be afraid to experiment with different markup percentages and pricing strategies to find the optimal approach for your business.

Conclusion

A 30% markup calculator is a powerful tool that can help businesses establish a consistent profit margin, ensure pricing accuracy, and make informed strategic decisions. By understanding the principles of markup and utilizing a calculator effectively, businesses can optimize their pricing strategies, enhance profitability, and achieve sustainable growth in the competitive market. However, it is crucial to approach pricing strategies with flexibility, taking into account industry standards, competition, and the specific needs of the business.

Closure

Thus, we hope this article has provided valuable insights into Demystifying the Power of Markup: Understanding and Utilizing a 30% Markup Calculator. We thank you for taking the time to read this article. See you in our next article!