Deciphering the Markup: Understanding the Cornerstone of Profitability

Related Articles: Deciphering the Markup: Understanding the Cornerstone of Profitability

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Deciphering the Markup: Understanding the Cornerstone of Profitability. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Deciphering the Markup: Understanding the Cornerstone of Profitability

- 2 Introduction

- 3 Deciphering the Markup: Understanding the Cornerstone of Profitability

- 3.1 What is Markup?

- 3.2 Understanding the Markup Formula:

- 3.3 The Significance of Markup:

- 3.4 Factors Influencing Markup:

- 3.5 Markup vs. Margin: A Clarification

- 3.6 Examples of Markup in Action:

- 3.7 Benefits of Utilizing Markup:

- 3.8 FAQs on Markup:

- 3.9 Tips for Effective Markup Implementation:

- 3.10 Conclusion:

- 4 Closure

Deciphering the Markup: Understanding the Cornerstone of Profitability

In the intricate world of business, profit is the lifeblood that sustains operations and fuels growth. A key element in achieving profitability is the strategic implementation of a markup, a crucial component that determines the selling price of a product or service. This article delves into the essence of markup, its calculation, its significance, and its implications for businesses across various industries.

What is Markup?

Markup, in its simplest form, is the percentage added to the cost of a product or service to determine its selling price. It represents the profit margin a business aims to achieve on each unit sold. The markup percentage is not a fixed value; it varies depending on factors like industry standards, competition, desired profit margins, and the inherent cost of production.

Understanding the Markup Formula:

The calculation of markup is a straightforward process:

Markup = (Selling Price – Cost Price) / Cost Price x 100

Where:

- Selling Price: The price at which a product or service is offered to customers.

- Cost Price: The total cost incurred in producing or acquiring a product or service. This includes raw materials, labor, manufacturing costs, overhead expenses, and other associated costs.

The Significance of Markup:

Markup plays a pivotal role in ensuring a business’s financial viability. It serves as a vital buffer to cover operational costs, generate profits, and invest in future growth. Here are some key reasons why markup is crucial:

- Profit Generation: Markup is the primary source of profit for a business. By adding a markup to the cost price, businesses can cover their expenses and generate a profit on each sale.

- Cost Recovery: Markup allows businesses to recover the costs associated with producing or acquiring a product or service. This includes direct costs like raw materials and labor, as well as indirect costs like rent, utilities, and administrative expenses.

- Pricing Strategy: Markup is an integral part of a business’s pricing strategy. It helps determine the selling price of products or services, ensuring they are priced competitively while maintaining profitability.

- Financial Stability: A well-calculated markup contributes to a business’s financial stability by ensuring sufficient revenue to cover operational costs, invest in growth initiatives, and manage unexpected expenses.

Factors Influencing Markup:

The determination of an appropriate markup percentage is influenced by a multitude of factors:

- Industry Standards: Different industries have established norms for markup percentages based on their unique cost structures and competitive landscapes.

- Competition: The level of competition in a market can impact markup. In highly competitive markets, businesses may have to lower their markup to remain competitive, while in less competitive markets, they may have more flexibility.

- Desired Profit Margin: Businesses set markup percentages based on their desired profit margin. Higher profit margins typically require higher markup percentages.

- Cost of Production: The cost of producing or acquiring a product or service directly influences markup. Higher costs necessitate higher markup percentages to maintain profitability.

- Market Demand: The demand for a product or service can affect markup. Higher demand may allow businesses to increase their markup, while lower demand may require them to lower their markup to attract customers.

Markup vs. Margin: A Clarification

It is essential to distinguish between markup and margin. While both are related to profitability, they represent different perspectives:

- Markup: As discussed, markup is the percentage added to the cost price to determine the selling price.

- Margin: Margin, on the other hand, is the percentage of profit generated on the selling price. It represents the difference between the selling price and the cost price, expressed as a percentage of the selling price.

Here’s how they relate:

- Markup is a measure of profit relative to cost.

- Margin is a measure of profit relative to revenue.

Examples of Markup in Action:

Consider these real-world examples:

- Retail: A clothing store purchases a shirt for $10. They apply a 50% markup to determine the selling price. Therefore, the selling price is $15 (10 + (10 x 0.5)).

- Food Service: A restaurant prepares a dish costing $5 to make. They apply a 100% markup to determine the selling price. This results in a selling price of $10 (5 + (5 x 1)).

- Professional Services: A consultant charges $100 per hour for their services. Their cost of providing these services (including overhead, marketing, and administrative expenses) is $50 per hour. Their markup is 100% (100 – 50) / 50 x 100.

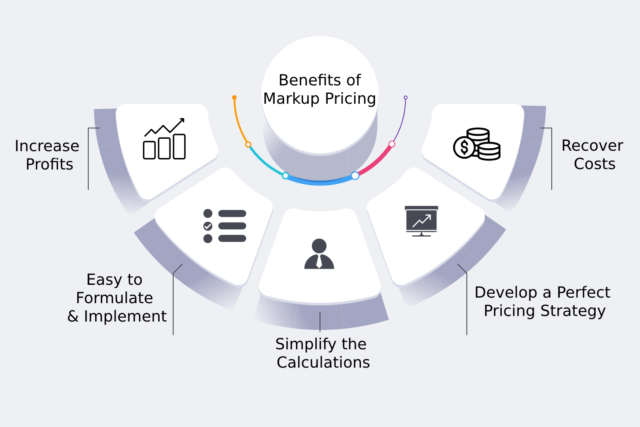

Benefits of Utilizing Markup:

- Improved Profitability: By strategically implementing markup, businesses can enhance their profitability and ensure financial stability.

- Enhanced Pricing Accuracy: Markup helps businesses establish a clear and consistent pricing strategy, ensuring they are pricing their products or services appropriately to cover costs and generate profits.

- Simplified Cost Management: Markup provides a framework for managing costs effectively, ensuring that businesses are charging enough to cover their expenses and achieve their desired profit margins.

- Enhanced Competitiveness: By understanding and leveraging markup, businesses can make informed pricing decisions that enable them to compete effectively in the market.

FAQs on Markup:

1. Is a higher markup always better?

While a higher markup may seem desirable, it’s crucial to consider market factors and customer demand. Excessive markups can deter customers and lead to lost sales.

2. How can I determine the right markup for my business?

The ideal markup varies depending on industry norms, competition, cost structures, and desired profit margins. Thorough market research and analysis are essential to establish an appropriate markup.

3. Does markup include taxes?

Typically, markup does not include taxes. Taxes are calculated separately and added to the selling price after markup is applied.

4. What are some common markup percentages used in different industries?

Markup percentages vary widely across industries. Retail stores often use markups of 50% or more, while professional service providers might use lower markups.

5. How can I adjust my markup if my costs increase?

If costs increase, businesses may need to adjust their markup to maintain profitability. This could involve increasing selling prices or exploring ways to reduce costs.

Tips for Effective Markup Implementation:

- Conduct thorough market research: Analyze competitor pricing and customer demand to determine an appropriate markup.

- Consider your cost structure: Accurately calculate your cost of production to ensure your markup covers all expenses.

- Monitor your performance: Track sales and profit margins to assess the effectiveness of your markup strategy.

- Be flexible: Adjust your markup as needed to respond to changing market conditions and customer preferences.

- Seek professional advice: Consult with financial advisors or business consultants to gain insights and guidance on markup strategies.

Conclusion:

Markup is an essential concept for any business seeking to achieve profitability and financial stability. By understanding the principles of markup, businesses can establish pricing strategies that ensure they recover costs, generate profits, and compete effectively in the market. Through careful calculation, strategic implementation, and ongoing monitoring, markup can be a powerful tool for businesses to achieve their financial goals and secure long-term success.

Closure

Thus, we hope this article has provided valuable insights into Deciphering the Markup: Understanding the Cornerstone of Profitability. We thank you for taking the time to read this article. See you in our next article!